February 3, 2026 | 5 min read

The Rise of BTR in the Southeast: What Wealth Advisors Need to Know for 2026 Allocation Models

Introduction: The Rise of Build to Rent in the Southeast

By 2026, build-to-rent will have established itself as a durable residential investment category rather than a transitional trend. Wealth advisors are increasingly evaluating it alongside traditional multifamily when building private real estate allocations for clients seeking income stability and long-term demand visibility.

The Southeast remains central to this conversation. Population inflows, steady job creation, and ongoing affordability constraints continue to support rental housing demand. For advisors constructing allocation models in 2026, understanding where and why build-to-rent works best is now essential.

Build to Rent in 2026

A More Measured Asset Class

Build-to-rent communities are purpose-built rental neighborhoods, typically consisting of detached homes or townhomes with centralized management. By 2026, the sector will benefit from several years of operational data across multiple Southeast markets.

Early execution risks have been reduced through better land selection, standardized construction, and improved property management systems. This maturity has led to more consistent occupancy, longer resident tenure, and clearer income forecasting.

From an allocation perspective, build-to-rent now functions as a hybrid between traditional multifamily income and single-family residential demand.

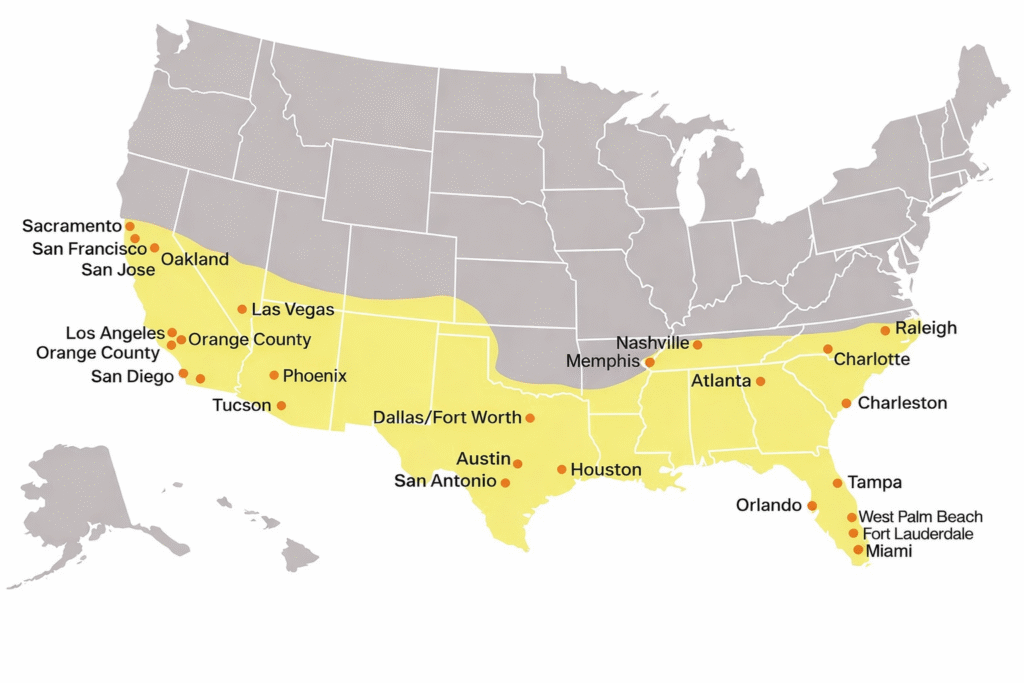

Why the Southeast Continues to Lead

The Southeast continues to outperform many regions on key housing fundamentals.

Population growth remains above national averages, driven by domestic migration and employment expansion. Job creation across healthcare, logistics, advanced manufacturing, and professional services supports household formation across renter profiles.

Land availability and suburban expansion patterns in many Southeast metros have allowed build-to-rent communities to scale without relying on dense urban infill. This has helped keep rents more attainable while maintaining operating efficiency.

Metro Level Build to Rent Insights for 2026

Atlanta, Georgia

Atlanta remains one of the most active build-to-rent markets in the country.

Population growth in outer suburban counties continues to support rental demand from households priced out of homeownership. Build-to-rent communities near logistics corridors and employment hubs benefit from consistent absorption and stable occupancy.

For advisors, Atlanta represents scale and liquidity. The market supports both income-focused strategies and longer hold periods.

Charlotte, North Carolina

Charlotte’s strength lies in employment diversity and steady household growth.

Financial services, healthcare, and technology employment have supported income stability across renter cohorts. Build-to-rent communities near expanding suburban job centers show lower turnover and longer average lease duration.

Charlotte appeals to advisors seeking a balance between growth and predictability rather than peak rent acceleration.

Raleigh, Durham

Raleigh-Durham continues to attract highly educated renters tied to research, healthcare, and technology sectors.

Build-to-rent communities here often command higher resident retention due to school quality and long-term employment prospects. While rent growth is more measured, income consistency remains strong.

Tampa and Orlando, Florida

Florida markets remain demand-driven, supported by migration, tourism-related employment, and expanding healthcare systems.

Build-to-rent communities in suburban Tampa and Orlando serve renters seeking space, flexibility, and proximity to growing job centers. Insurance and climate considerations require careful underwriting, but well-located assets continue to perform.

For advisors, Florida exposure may carry higher variability but also long-term demographic support.

Performance Characteristics Entering 2026

|

Factor |

Build-to-Rent Strategy | New Development Multifamily |

| Time to Cash Flow | Shorter home leases as each phase is completed | Longer; cash flow begins after full construction and lease-up |

| Risk Profile | Moderate; simpler builds with proven rental demand | Higher, more complex construction and market exposure |

| Tenant Profile | Families, remote professionals, and long-term renters | Young professionals and lifestyle renters |

| Exit Flexibility | Sell homes individually, as a portfolio, or recapitalize | Refinance or sell the entire stabilized community |

| Typical Hold Period | 3 to 7 years |

5 to 10 years |

Across Southeast markets, build-to-rent communities in 2026 show consistent operating traits.

Occupancy rates commonly remain in the mid-ninety percent range. Turnover is generally lower than in traditional apartments due to home-style layouts and resident preferences for longer stays.

Rent growth has normalized from earlier cycle peaks, which improves underwriting clarity. Expense growth has also moderated, supporting more stable net operating income projections.

How Build to Rent Fits 2026 Allocation Models

For wealth advisors, build-to-rent serves several clear portfolio functions.

Income Reliability

Housing demand remains essential. Purpose-built rental communities support recurring cash flow even during broader market uncertainty.

Diversification Within Private Real Estate

Build-to-rent adds residential exposure that behaves differently from urban apartments or mixed-use assets.

Client Alignment

Many investors understand housing intuitively. Build-to-rent can be easier to explain and contextualize within long-term planning discussions.

Risk assessment remains critical. Advisors should evaluate sponsor execution, local supply trends, financing structure, and market-specific employment dynamics.

Catalyst and Market Selection

Catalyst maintains a focused approach to Southeast residential development. The firm emphasizes markets where population growth, job creation, and housing demand align over multi-year horizons.

By concentrating on fundamentals rather than short-term pricing shifts, Catalyst’s strategy reflects the type of disciplined underwriting wealth advisors seek when evaluating private real estate exposure for clients.

Looking Ahead

As 2026 allocation models continue to evolve, build-to-rent has earned its place as a considered residential strategy. The Southeast’s demographic strength, combined with more mature operational data, allows advisors to evaluate this asset class with greater confidence.

For clients seeking income durability, real asset diversification, and long-term housing demand exposure, build-to-rent can play a constructive role when selected thoughtfully and aligned with portfolio objectives.

Explore Catalyst!

Join Us

Subscribe to our newsletter.