January 30, 2025 | 4 min read

Tariffs & Construction Costs: How to Invest Smart in 2025

Introduction

As we head deeper into 2025, the multifamily real estate sector faces significant challenges—and opportunities—driven largely by evolving tariffs and construction cost dynamics. For savvy investors, understanding these factors is crucial to making smart, profitable decisions in today’s complex market.

At Catalyt, we believe in leveraging data and deep industry insights to unlock value for our investors. In this article, we break down the latest trends in tariffs and construction costs, highlight how these impact multifamily developments, and share actionable strategies to invest smart in 2025. While our current projects have not experienced any tariff-related cost-increases, nor have our upcoming projects, it is something we are closely monitoring.

Why Tariffs Matter in Multifamily Development

Tariffs imposed on imported materials—like steel, lumber, and aluminum—directly increase construction costs, squeezing profit margins on residential projects. Since 2018, tariffs on key building materials have fluctuated due to geopolitical tensions and trade policy shifts, and their ripple effects continue today.

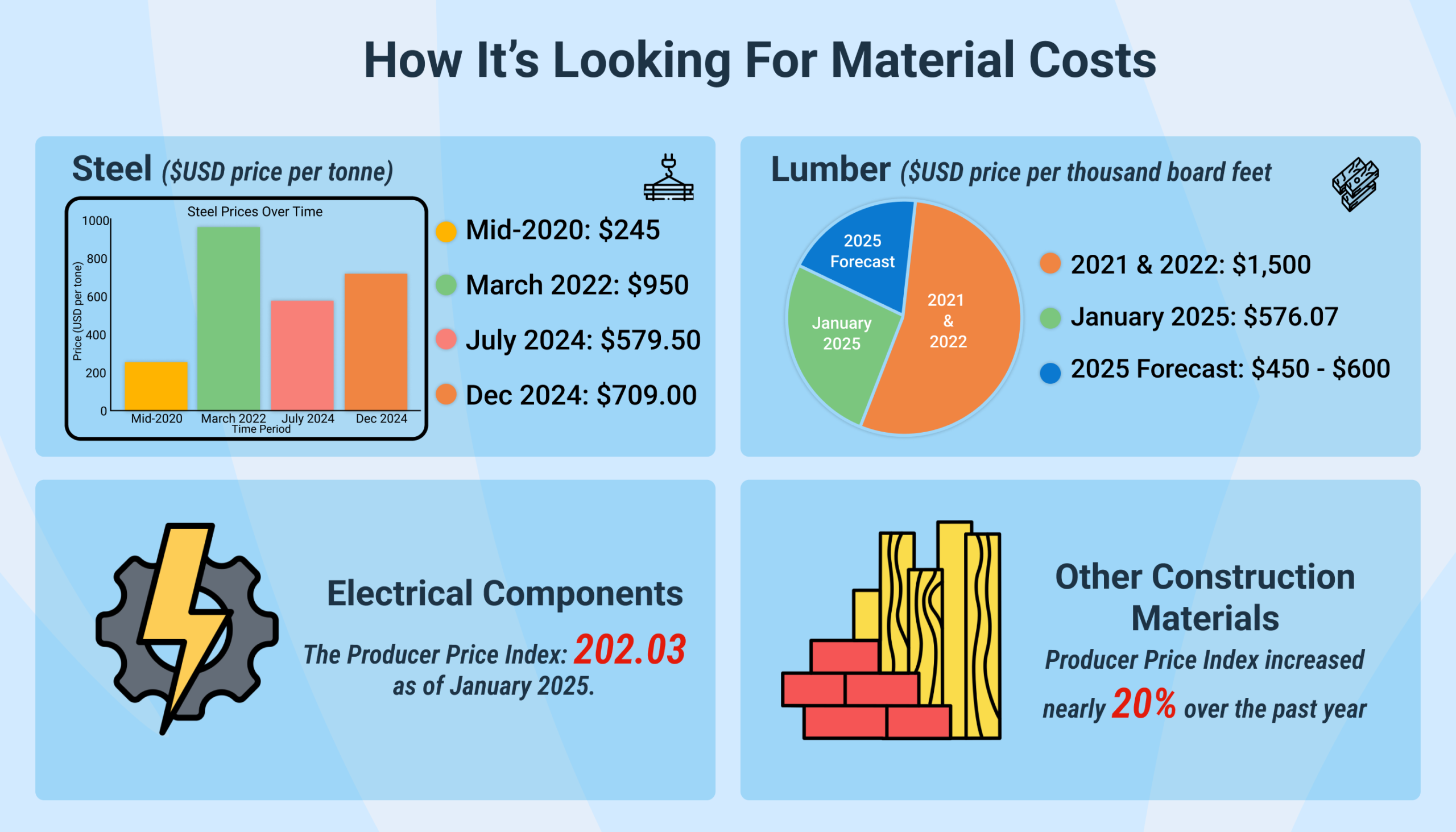

- Steel prices surged nearly 60% between 2020 and 2023, largely due to tariffs and supply chain disruptions.

- Lumber costs saw unprecedented volatility, hitting record highs in 2021 but stabilizing somewhat by 2024, though still elevated compared to pre-pandemic levels.

- According to recent data from the National Association of Home Builders (NAHB), tariffs and supply shortages have contributed to a 10-15% increase in overall construction costs for multifamily projects since 2022.

For multifamily developers and investors, this means rising hard costs that must be carefully managed.

The Impact on Construction Costs in 2025

Img Source

Recent reports indicate that while some material costs are stabilizing, inflationary pressures and tariffs keep overall construction expenses elevated:

- Construction cost inflation for multifamily projects is projected at around 6% annually in 2025, a rate higher than general inflation.

- Labor shortages in skilled trades exacerbate cost increases, pushing wage premiums.

- Tariff-related delays in material availability can extend project timelines, increasing carrying costs and reducing returns.

Understanding these trends enables investors to price risk appropriately and identify projects with genuine value-add potential.

How to Invest Smart in 2025: Key Strategies

- Focus on Experienced Developers with Cost Controls

Partner with firms like Catalyst Capital Partners, which combine institutional-quality expertise with innovative construction management techniques and technology. Our 15 decades of combined experience in real estate development help us mitigate tariff-driven cost risks. - Invest in Markets with Strong Demand and Supply Constraints

High-demand urban and suburban multifamily markets with limited new supply continue to offer resilient cash flows and upside potential, even amid rising costs. - Seek Value-Creation Opportunities

Look for properties where operational improvements, repositioning, or redevelopment can boost net operating income, offsetting cost pressures. - Consider Alternative Building Materials and Methods

Modular construction, advanced prefabrication, and sustainable materials can reduce exposure to tariff-affected inputs and speed up timelines. - Use Thorough Risk Assessment and Scenario Modeling

Employ data-driven analysis to forecast how fluctuating tariffs and costs impact projected returns. Catalyst’s rigorous deal flow and risk assessment processes ensure we identify below-market opportunities with precise value-creation potential.

Why Catalyst Capital Partners is Your Partner in Navigating 2025

At Catalyst, we redefine real estate investing by integrating technology, deep market expertise, and a forward-thinking mindset. We deliver projects that drive above-market returns, even in a challenging tariff and inflationary environment.

Our approach includes:

- Proactive material sourcing strategies to minimize tariff impacts

- Innovative project management to control costs and timelines

- Investment in high-growth, undersupplied markets with strong fundamentals

- Transparent communication and alignment with investor goals

By choosing Catalyst Capital Partners, you gain a partner equipped to navigate the complexities of 2025’s multifamily market, turning challenges into opportunities.

Conclusion

Tariffs and rising construction costs are reshaping the multifamily investment landscape in 2025. However, with the right knowledge, strategic partnerships, and careful planning, investors can continue to achieve strong, sustainable returns.

At Catalyst, we are committed to providing actionable real estate opportunities that thrive in today’s market conditions. Ready to invest smart? Learn more about how we can help you unlock value in multifamily development.

Learn More About Catalyst

Building Relationships. Multifamily Development & Investment.

www.catalystcp.com

Join Us

Subscribe to our newsletter.